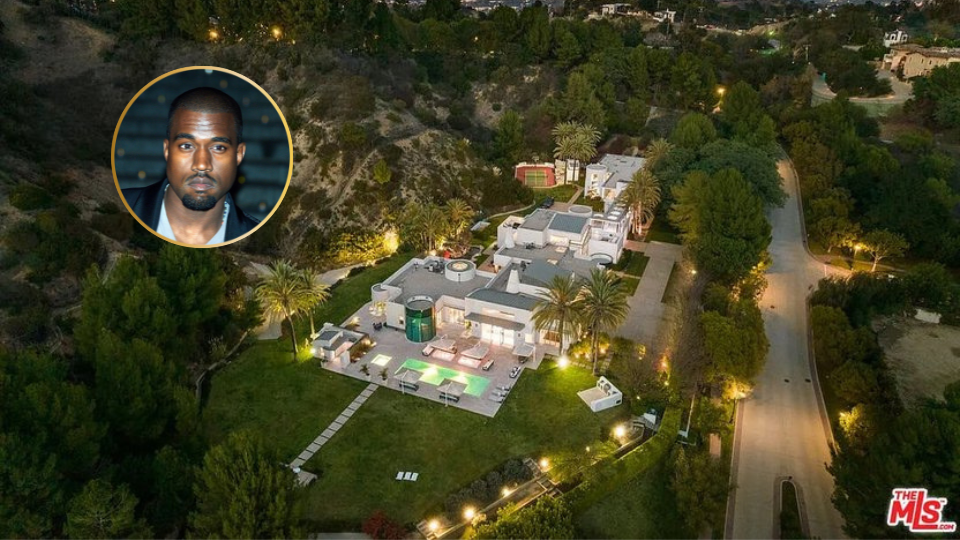

Kanye West, the visionary and bold entrepreneur, has made waves once again with a striking real estate move. Recently, he purchased a $35 million mansion in Beverly Hills—not for personal use, but as an investment with plans for future income generation.

This high-stakes venture highlights West’s unique approach to financing, offering insights that savvy investors, especially in the luxury market, might find thought-provoking. Unlike a typical purchase, Kanye financed this estate with an unconventional combination of loans from high-risk lenders—a move that signals both ingenuity and risk tolerance.

An Unusual Financial Strategy

To fund the purchase, Kanye secured $15.5 million in loans from multiple sources, including $12.5 million from Lone Oak Fund, known for high-interest short-term bridge loans. These types of loans, often reserved for commercial investors, carry rates between 8.5% and 10%, requiring interest-only payments—a clear departure from traditional financing. Additionally, Kanye accessed a $3 million loan from RGGL LLC and Provident Trust Group, the latter specializing in self-directed retirement accounts, suggesting that Kanye may have tapped into his own pension funds.

Strategic financing advisor Doug Perry explained the potential pitfalls of Kanye’s funding choice. “This kind of high-risk financing isn’t for the faint of heart. Private lenders often cap their exposure, and Kanye’s arrangement reflects a layered approach to secure enough capital while assuming significant financial risk.”

The Purpose Behind the Purchase

The Beverly Hills mansion, located in the exclusive Beverly Park enclave, offers amenities such as 11 bedrooms, 18 bathrooms, and neighbors like Adele and Justin Bieber. But Kanye and his wife, Bianca Censori, aren’t planning to move in. Instead, they aim to turn the mansion into an income-generating asset, possibly through rentals or long-term value appreciation.

Richard Glassman, a private lender involved in the deal, expressed confidence in the mansion’s potential. “With a 40% loan-to-value ratio, we’re on solid ground. If Kanye defaults, we acquire a high-value property. But, ideally, the investment performs as anticipated, delivering robust returns.”

What Does This Mean for Atlanta’s Luxury Real Estate Market?

Kanye’s bold investment choices showcase both the potential rewards and risks inherent in luxury real estate—a lesson that Atlanta’s high-end investors can take to heart. As the luxury market grows in Atlanta, with properties boasting exclusive amenities and prime locations, buyers here might consider diverse strategies to optimize their investment potential, especially in a climate of fluctuating interest rates and creative financing options.

Are you considering a high-stakes investment in Atlanta’s luxury market? At Atlanta Luxury Homes and Condos, we understand the complexities of high-value transactions and offer tailored guidance on sophisticated financing strategies, risk management, and maximizing returns. Let’s discuss how to make your next property investment as visionary—yet secure—as it can be. Reach out today, and let’s turn your ambition into action.