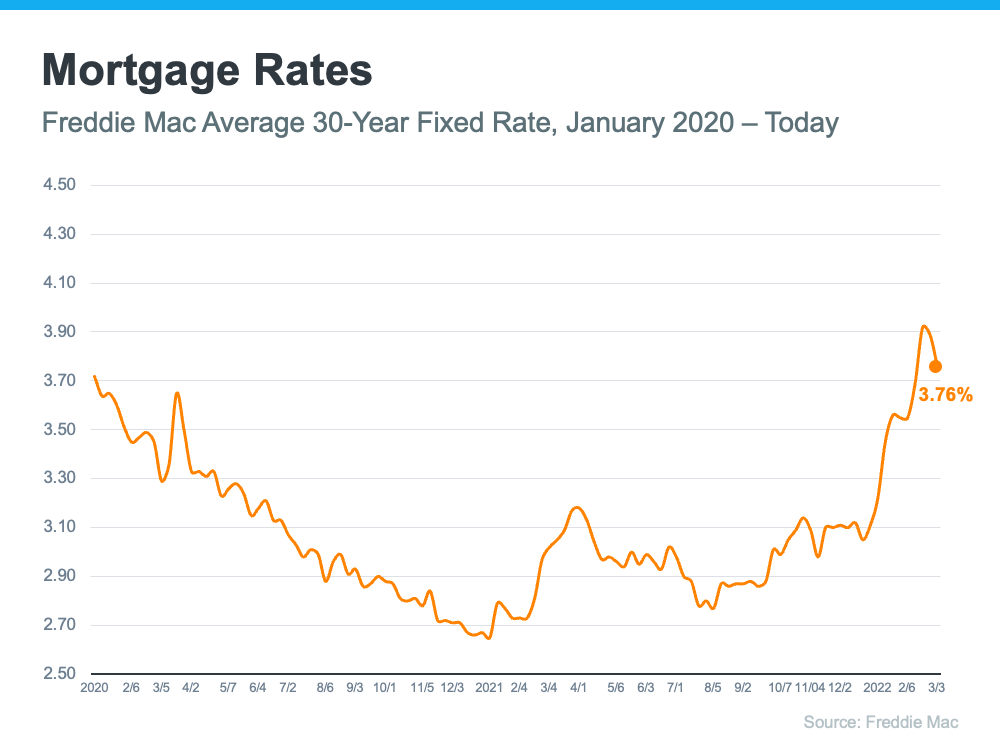

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has dropped slightly over the past few weeks (see graph below):

The recent decline in mortgage rates is primarily due to growing uncertainty around geopolitical tensions surrounding Russia and Ukraine. But experts say it’s to be expected.

Here’s a look at how industry leaders are explaining the impact global uncertainty has on mortgage rates:

Odeta Kushi, Deputy Chief Economist at First American, says:

“While mortgage rates trended upward in 2022, one unintended side effect of global uncertainty is that it often results in downward pressure on mortgage rates.”

Kushi’s insights are a reminder that, historically, economic uncertainty can impact the 10-year treasury yield – which has a long-standing relationship with mortgage rates and is often considered a leading indicator of where rates are headed. Basically, events overseas can have an impact on mortgage rates here, and that’s what we’re seeing today.

Will Mortgage Rates Stay Down?

While no one has a crystal ball to predict exactly what will happen with rates in the future, experts agree this slight decline is temporary.

Rates will likely fluctuate in the short-term based on what’s happening globally. But before long, experts project rates will renew their climb. If you’re in the market to buy a home, doing so before rates start to rise again may be your most affordable option.

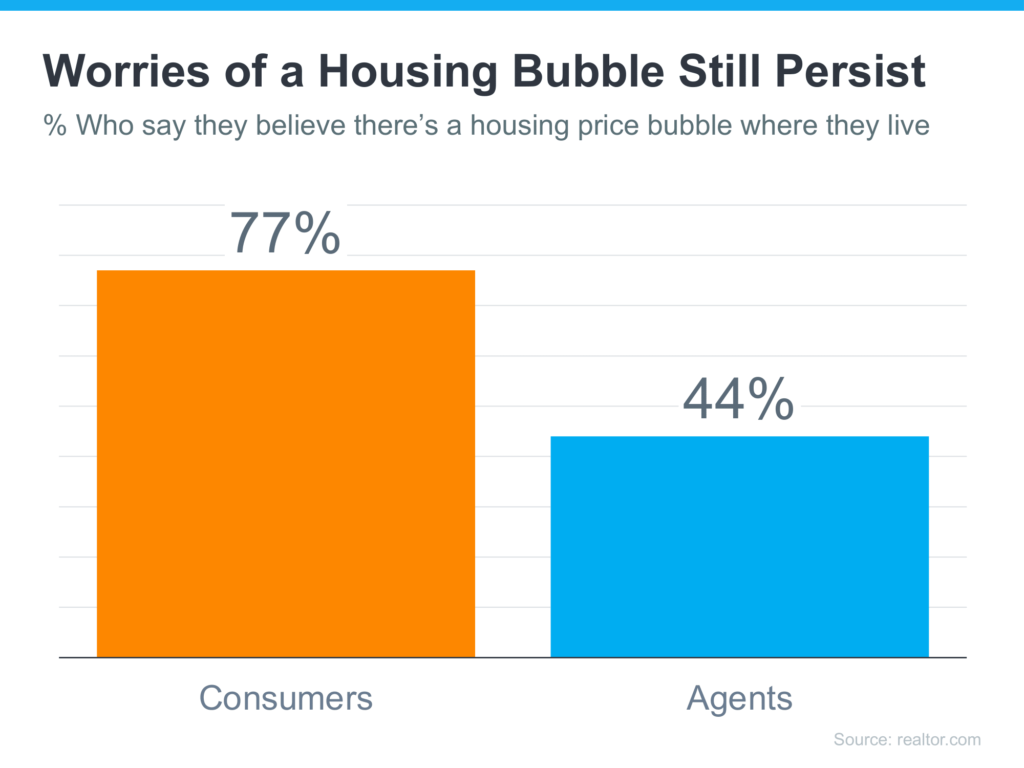

77% of Consumers Believe We’re in a Housing Bubble

Home buyers and sellers are rightfully concerned about how fast prices are rising, especially those who remember the housing market crash during the Great Recession,” says Daryl Fairweather, Redfin’s chief economist. “What we’re going through right now is closer to a ripple in the water than a bubble. Mortgage rates are already going up, which will likely stabilize demand and reduce the risk of a bubble that could burst.

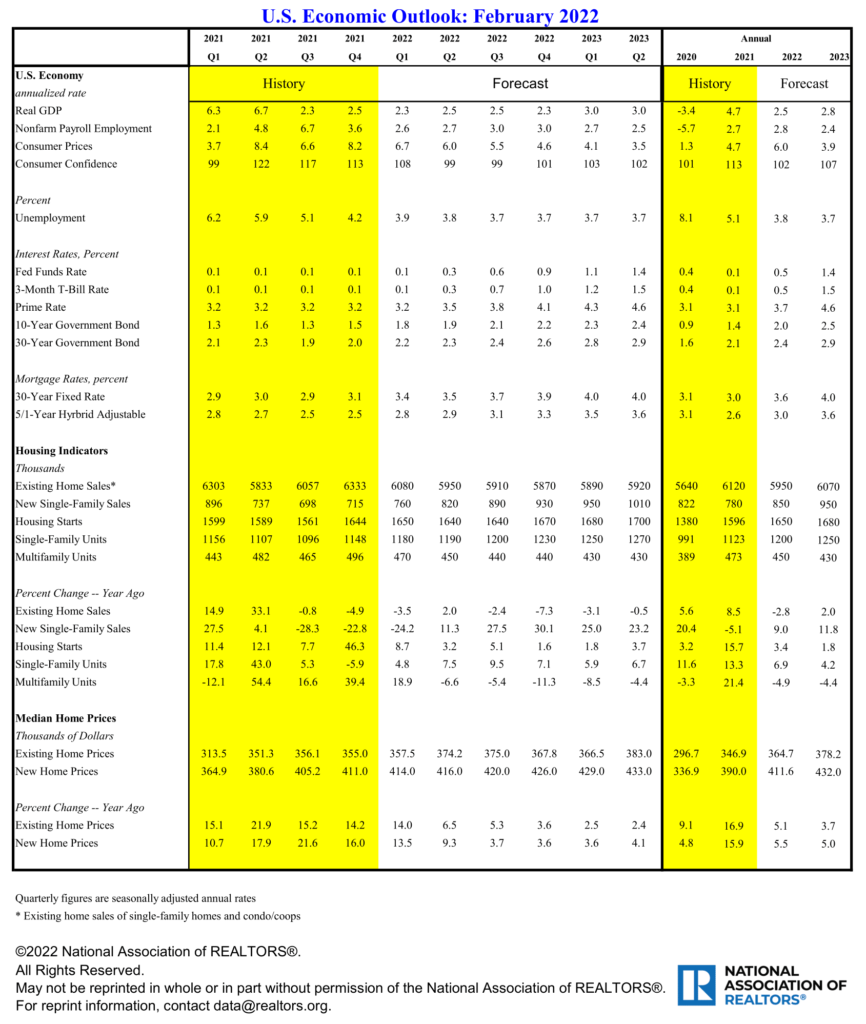

Home prices are expected to slow in 2022. The National Association of REALTORS® predicts price growth to moderate to 3% to 5% in 2022, much lower than the nearly 16% annual growth existing-home sale prices posted in December 2021.

Inflation Accelerates in February as Energy Prices Jump, but Labor Market Indicators Remain Strong

Fortunately, however, unlike the high inflationary period in the late 1970s/early 1980s, the U.S. is currently experiencing one of the strongest labor markets on record, pointing to near-term resilience. While quits have fallen from their recent peaks, the level remains nearly 20 percent higher than the number of quits that occurred in January 2020, indicating workers are confident they can find new, likely better-paying jobs (a Pew research study showed 63 percent of workers who quit their jobs in 2021 cited low pay as a reason for leaving). That’s consistent with job openings remaining near record highs. Given high inflation and a strong labor market, we continue to expect the Fed to begin hiking rates at their meeting next week.

Bottomline

Mortgage rates are an important piece of the puzzle because they help determine how much you’ll owe on your monthly mortgage payment in your next home. Let’s connect so you have up-to-date information on rates and trusted advice on how to time your next move.